US DOLLAR

Summary - April Trading Overview

The Mini U.S. Dollar Index® Futures (SDX) demonstrated resilience and volatility throughout April, starting the month strong with a rally driven by better-than-expected ISM Manufacturing PMI data. The index closed the first trading day with a gain of 0.47%, briefly entering a resistance zone between 104.61 and 104.86. However, subsequent days saw weakening demand, influenced by cautious remarks from Fed Chair Powell and mixed economic data, including ADP Employment Change and Nonfarm Payrolls.

Despite these challenges, the index found support mid-month around the daily Bollinger Bands midpoint, leading to a notable surge following the release of inflation data and the FOMC minutes. The SDX closed the month with a robust gain of 1.76%, indicating strong buying interest at higher levels.

MARKET CONDITIONS:

Forward-Looking Outlook - May Predictions

The focus for May shifts to several high-impact economic events that could significantly influence the direction of the U.S. Dollar. These include the Consumer Price Index, Retail Sales data, and preliminary GDP figures, each serving as a critical barometer of economic health and potential triggers for volatility in the SDX.

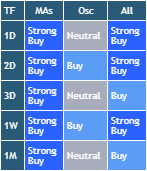

Technical indicators remain favorable, with moving averages suggesting a strong buy and oscillators indicating both buy and neutral conditions. Historical volatility predicts potential price movement between 108.45 and 104.08 in the upcoming month, providing a broad range for traders to plan their strategies.

Strategic Implications and Market Dynamics

The SDX's performance is intricately tied to U.S. economic indicators and global market sentiment. As such, upcoming economic releases and their interpretations will play a pivotal role in shaping market dynamics. Traders should consider the weekly support and resistance levels identified using AutoUFOs® as crucial thresholds for their trading activities.

In navigating these conditions, investors and traders must remain agile, leveraging advanced analytical tools to adapt to the fast-paced changes in market conditions. The interplay of technical analysis, economic data, and geopolitical events will continue to drive the strategic decisions in trading the SDX.

BITCOIN

Summary - Recent Trading Performance

Bitcoin futures (BMC) experienced a notable retracement in April, closing the month at $62,262, which represents a 12.9% decrease from the March close. This adjustment followed the much-anticipated Bitcoin blockchain network's fourth "halving" event, which reduced the bitcoin miner reward from 6.25 bitcoins to 3.125 bitcoins. Despite the pullback, optimism remains due to sustained investment flows into digital assets and growing interest in diversifying into digital asset-based exchange-traded funds (ETFs).

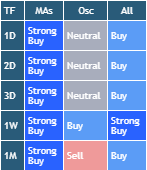

The market's mixed reaction is evidenced by the varied signals from daily and weekly technical indicators, with technical oscillators showing neutral conditions. This suggests a cautious outlook among traders as they navigate through the evolving landscape of Bitcoin trading post-halving.

MARKET CONDITIONS:

Forward-Looking Outlook - Upcoming Regulatory Decisions

May holds significant developments for Bitcoin futures, notably the United States Securities Exchange Commission's impending response to applications for options trading on spot-bitcoin ETFs. This decision could potentially influence the trajectory of Bitcoin prices and impact investor sentiment across the cryptocurrency market.

The historical volatility indicates a potential price range between $50,167 to $74,355 in the upcoming month, highlighting the market's responsiveness to regulatory and market developments. Traders might look to the established weekly support and resistance areas at $50,850 to $52,670 and $69,262 to $72,612, respectively, as key levels for making strategic decisions.

Market Dynamics and Strategic Considerations

As Bitcoin continues to mature as an asset class, the interplay between regulatory decisions and technological advancements such as the halving will play crucial roles in shaping its future. Investors and traders are advised to stay attuned to regulatory developments and market sentiment, utilizing advanced analytical tools to navigate the complexities of cryptocurrency futures trading effectively.

The upcoming regulatory decisions and continued adaptation to the post-halving environment will likely drive significant movements in the BMC, offering both challenges and opportunities for astute market participants.

ASIA TECH

Summary - April Trading Dynamics

The Micro Asia Tech 30 Index Futures (ATI) experienced a slight retracement in April, recording a 1.9% decline from the previous month. The index showed a mixed performance across Asian markets, particularly noting a downturn in South Korean components.

Chinese stocks mostly trended higher, with significant gains in companies like Bilibili, Xiaomi, and Tencent, suggesting strong market sentiment towards certain tech sectors. However, the overall mixed results across the region, including declines in major Taiwanese and Korean tech stocks, reflect the challenging and competitive landscape of the Asian technology sector.

MARKET CONDITIONS:

Forward-Looking Outlook - Key Economic Events

May is set to be a pivotal month for ATI, with several major economic events on the horizon, including China's CPI, the PBOC Interest Rate Decision, and Manufacturing PMI. These indicators will provide crucial insights into the economic health of the region and potentially guide the market's next moves.

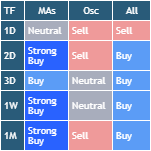

The index's technical setup indicates strong buying conditions despite recent pullbacks, with technical oscillators pointing towards neutral market conditions. The historical volatility suggests a possible price range between $3,320 to $4,005 in the upcoming month, offering a window into expected market fluctuations.

Market Dynamics and Investment Insights

Investors and traders should monitor the support and resistance levels closely, with $3,162 to $3,390 and $3,716 to $3,792 acting as critical thresholds. These levels will be key for planning strategic entries and exits in response to unfolding economic developments.

The diverse and vibrant nature of the Asian tech industry, coupled with cutting-edge advancements, continues to make ATI a dynamic and potentially lucrative market for informed investors. Staying abreast of regional economic developments and leveraging sophisticated trading tools will be essential for navigating the complexities of this sector.

BRENT

Summary - Market Dynamics Amidst Geopolitical Tensions

The Mini Brent Crude Futures (BM) experienced a volatile month, starting strong and peaking at $92.18 before closing at $86.33, a slight decrease of 0.8% from the previous month. The early month's fluctuations were largely influenced by escalating hostilities in the Middle East, affecting global oil prices.

Further complicating the market were ongoing drone attacks by Ukraine on Russian oil infrastructure, aimed at economically damaging Russia by forcing costly repairs and defensive expenditures. These actions have sustained tensions and have influenced oil market dynamics, as countries and companies reassess their geopolitical and economic strategies.

MARKET CONDITIONS:

Forward-Looking Outlook - Upcoming High-Impact Events

The market is bracing for the 54th Joint Ministerial Monitoring Committee (JMMC) and the 37th OPEC and non-OPEC Ministerial Meeting scheduled for 1 June 2024. These meetings are critical as they may dictate future production policies and have a significant impact on global oil supply and pricing strategies.

Technical analysis suggests a continued market inclination towards buying, with oscillators presenting a mixed market state. Historical volatility indicates that the price could fluctuate between $80.63 and $92.03 in the coming days, presenting a substantial range for trading strategies.

Market Dynamics and Strategic Insights

As geopolitical events continue to unfold, their impact on oil prices underscores the complexity of global energy markets. Investors and traders should monitor these developments closely, using advanced analytical tools to navigate the potential market swings effectively.

The strategic positioning ahead of the OPEC meetings and ongoing geopolitical tensions requires a nuanced understanding of market signals and the ability to react swiftly to news and trends. The oil market remains a focal point of global economic health and geopolitical strategy, demanding vigilant analysis and strategic foresight.

Please note that this report provides an overview of the market conditions and does not constitute financial advice. It is recommended that individuals seek the guidance of a qualified financial professional before making any investment decisions.

Please feel free to join our ˲tradewithufos community, we provide comprehensive trading courses and trading apps.

Apps for market analysis and trading:

www.tradewithufos.com/apps

FREE forever membership for everyone:

www.tradewithufos.com/membership

TRADDICTIV · Research Team